Multiple Choice

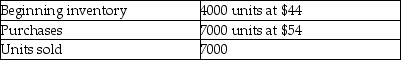

Using the following data, by how much would taxable income change if LIFO is used rather than FIFO?

A) There is no difference.

B) Increase by $40,000.

C) Decrease by $40,000.

D) Decrease by $70,000.

Correct Answer:

Verified

Related Questions

Q142: The LIFO Reserve is the difference between

Q148: The Internal Revenue Service allows companies to

Q152: Under the periodic inventory system,a physical inventory

Q154: Under the periodic inventory system,the journal entry

Q160: If ending inventory for the year ended

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents