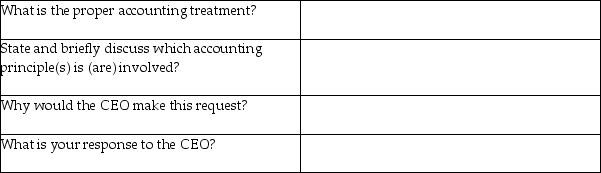

Fiscal year 2016 (April 1, 2016 - March 31, 2017)has been great for Murphy Incorporated. Net income is higher than expected. Management believes that fiscal year 2017 will not be as profitable. On December 31, 2106, Murphy signed a one year contract for monthly advertising for $2,400,000. The advertising began on January 1, 2017. The CEO has asked the accountant to expense the $2,400,000 during fiscal year 2016.

You are the accountant. Comment on each of the following:

Correct Answer:

Verified

Q48: The revenue principle deals with the following:

A)when

Q53: According to the joint new standard for

Q54: Which of the following is a TRUE

Q55: Some accounts do not need to be

Q55: On June 1, 2017, Starbucks paid the

Q57: The revenue principle requires that a business

Q65: Unearned Service Revenue is a revenue account.

Q73: The accumulated depreciation account decreases over the

Q74: Prepaid expenses will become _ when their

Q75: One company's prepaid expense is another company's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents