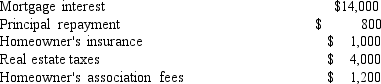

Jackie is in the 28% marginal tax bracket and has no other itemized deductions except those related to her home.If her standard deduction is $4,750 and she incurs the following costs related to housing,how much tax savings will she receive as a result of her home purchase?

A) $13,250

B) $ 5,040

C) $ 3,710

D) $ 2,800

E) none

Correct Answer:

Verified

Q88: The capital cost reduction on a vehicle

Q94: Anna purchased a vehicle six years ago

Q102: Which of the following is not associated

Q104: The financing rate on the car you

Q107: The seller of the house typically pays

Q109: In which of the following situations would

Q120: At the end of the lease period,you

Q121: Most lenders do not want mortgage payments

Q134: One would be more likely to pay

Q138: If the maximum loan-to-value ratio that a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents