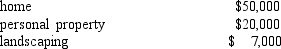

Carl and Alexandra purchased a $200,000 homeowners policy for their house in 1988.They have renewed the policy each year since and have replacement coverage.This policy has a $1,000 deductible.Their home now has a replacement value of $275,000.Last week they came home to find a small fire which caused the following damages:

Assume Carl and Alexandra have a standard HO-3 policy with personal property covered at 50% and landscaping covered for 10%.How much will the insurance pay for the losses of their personal property and landscaping?

A) $15,000

B) $ 9,700

C) $24,545

D) $27,000

E) $30,000

Correct Answer:

Verified

Q87: The deductible on a standard homeowners' policy

Q103: To reduce auto insurance premiums as your

Q105: Homeowners' insurance will cover which of the

Q107: Auto medical payments cover

A) anyone in your

Q109: Which of the following events would probably

Q109: Premium discounts may result from

A)safe driving record

Q113: Auto insurance is needed primarily because of

A)potential

Q114: Liability coverage provides payment to the

A) insured

Q122: Auto insurance premiums would be affected by

A)

Q127: A claims adjustor may work for

A) the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents