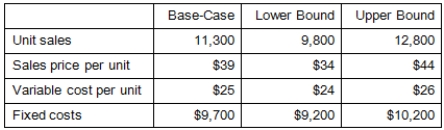

You are analyzing a project and have developed the following estimates.The depreciation is $47,900 a year and the tax rate is 35 percent.What is the worst-case operating cash flow?

A) -$2,545

B) $11,145

C) $88,855

D) $27,556

E) $61,095

Correct Answer:

Verified

Q94: Lee's currently sells 13,800 motor homes per

Q95: The Golf Range is considering adding an

Q96: Three years ago, Stock Tek purchased some

Q97: An asset used in a three-year project

Q98: Outdoor Sports is considering adding a miniature

Q100: A project has an initial requirement of

Q101: Cinram Machines has the following estimates for

Q102: An all-equity firm has net income of

Q103: A debt-free firm has net income of

Q104: A cost-cutting project will decrease costs by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents