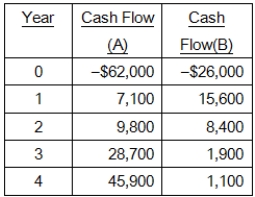

Baker's Supply imposes a payback cutoff of 3.5 years for its international investment projects.If the company has the following two projects available, which project(s) , if either, should it accept?

A) Reject both Projects A and B

B) Accept Project A but not Project B

C) Accept Project B but not Project A

D) Both Project A and B are acceptable but you can select only one project

E) Accept both Projects A and B

Correct Answer:

Verified

Q84: You are considering the following two mutually

Q85: Performance Needlework needs to purchase a new

Q86: Soft and Cuddly is considering a new

Q87: Diamond Enterprises is considering a project that

Q88: You are considering the following two mutually

Q90: A project has the following cash flows.What

Q91: Miller Brothers is considering a project that

Q92: The Black Horse is currently considering a

Q93: A project has expected cash inflows, starting

Q94: The net present value of a project's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents