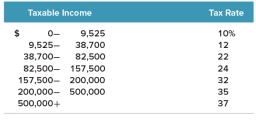

Daisy Co.has $267,000 in taxable income and Binget Co.has $1,600,000 in taxable income.Suppose both firms have identified a new project that will increase taxable income by $10,000.The additional project will increase Able Co.'s taxes by _____ and Bravo Co.'s taxes by ____.

A) $1,500; $1,500

B) $3,400; $3,400

C) $3,400; $3,700

D) $3,500; $3,700

E) $3,700; $3,700

Correct Answer:

Verified

Q98: A balance sheet shows beginning values of

Q99: The Underground Cafe has an operating cash

Q100: Daniel's Market has sales of $43,800, costs

Q101: Dixie's sales for the year were $1,678,000.Cost

Q102: Joie's Fashions has current liabilities of $45,600

Q104: Sunny Disposition, Inc.has net working capital of

Q105: Kat Outfitting currently has $22,500 in cash.The

Q106: For Year 2016, Precision Masters had sales

Q107: Zoey Pet Supply had $314,000 in net

Q108: Suzette's Market had long-term debt of $638,100

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents