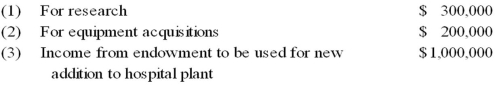

A private, not-for-profit hospital received the following restricted contributions and other receipts during the year ended December 31, 20X8:  None of the contributions or other receipts were expended during the ended December 31, 20X8. For the year ended December 31, 20X8, what amount would be reported on the hospital's statement of changes in net assets as an increase in temporarily restricted net assets?

None of the contributions or other receipts were expended during the ended December 31, 20X8. For the year ended December 31, 20X8, what amount would be reported on the hospital's statement of changes in net assets as an increase in temporarily restricted net assets?

A) $1,500,000

B) $1,200,000

C) $500,000

D) $300,000

Correct Answer:

Verified

Q23: A private,not-for-profit hospital received a donation of

Q40: On the statement of operations prepared for

Q41: The transactions listed in the following questions

Q42: The transactions listed in the following questions

Q43: The transactions listed in the following questions

Q47: A private, not-for-profit hospital received a contribution

Q48: A private, not-for-profit hospital received a contribution

Q49: A private, not-for-profit hospital received a contribution

Q53: Good Faith Hospital,operated by a religious organization,billed

Q58: The governing board of a hospital operated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents