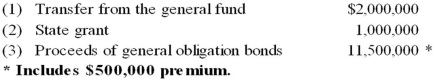

On July 1, 20X8, Cleveland established a capital projects fund to construct a new town hall. Financing for construction came from the following sources:  Construction of the town hall was completed on June 15, 20X9. For the fiscal year ended June 30, 20X9, what amount should Cleveland's capital projects fund report for revenues on its statement of revenues, expenditures, and changes in fund balance?

Construction of the town hall was completed on June 15, 20X9. For the fiscal year ended June 30, 20X9, what amount should Cleveland's capital projects fund report for revenues on its statement of revenues, expenditures, and changes in fund balance?

A) $1,000,000

B) $1,500,000

C) $3,500,000

D) $14,500,000

Correct Answer:

Verified

Q1: Upon completion of construction and full payment

Q4: Which of the following items would not

Q5: The City of Fargo issued general obligation

Q9: The town of Decorah issued general obligation

Q9: Note: This is a Kaplan CPA Review

Q14: Ponca City issued general obligation bonds to

Q15: When a capital projects fund transfers a

Q17: For which of the following funds are

Q18: A special revenue fund should be used

Q20: Fixed assets and investments are reported in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents