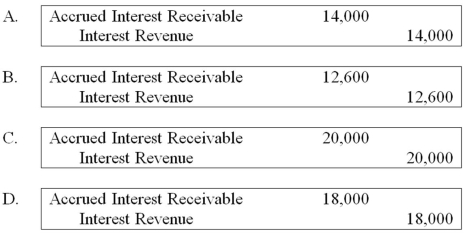

On January 1, 20X1, Washington City received 200,000 from an estate with the stipulation that the money be invested and the income be used to provide maintenance to the city cemetery. The money was invested in 7% governmental securities at 90 to yield an effective interest rate of 10%. The following journal entry would be made to account for the accrued interest of the permanent fund:

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q22: For which of the following long-term debt

Q29: What account should be debited in the

Q30: Arlington has a debt service fund which

Q31: An enterprise fund of Grist was billed

Q36: At June 30, 20X9, total assets for

Q43: Note: This is a Kaplan CPA Review

Q44: Riviera Township reported the following data for

Q45: Note: This is a Kaplan CPA Review

Q52: A tax collection fund that collects property

Q58: Enterprise and internal service funds should recognize

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents