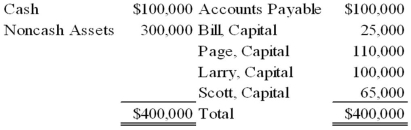

Bill, Page, Larry, and Scott have decided to terminate their partnership. The partnership's balance sheet at the time they decide to wind up is as follows:  During the winding up of the partnership, the other assets are sold for $150,000 and the accounts payable are paid. Page and Larry are personally solvent, but Bill and Scott are personally insolvent. The partners share profits and losses in the ratio of 3:2:1:4.

During the winding up of the partnership, the other assets are sold for $150,000 and the accounts payable are paid. Page and Larry are personally solvent, but Bill and Scott are personally insolvent. The partners share profits and losses in the ratio of 3:2:1:4.

Based on the preceding information, what amount will be paid out to Bill upon liquidation of the partnership?

A) $0

B) $5,000

C) $25,000

D) $2,500

Correct Answer:

Verified

Q1: When is a partnership considered to be

Q7: The trial balance of WM Partnership is

Q12: In order to avoid inequalities in the

Q14: Bill, Page, Larry, and Scott have decided

Q15: Note: This is a Kaplan CPA Review

Q16: Bill, Page, Larry, and Scott have decided

Q19: The CRT partnership has decided to terminate

Q21: The BIG Partnership has decided to liquidate

Q22: On December 1, 20X9, the partners of

Q23: All assets and liabilities are transferred to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents