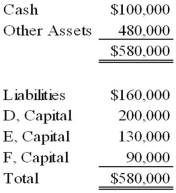

The following condensed balance sheet is presented for the partnership of D, E, and F who share profits and losses in the ratio of 5:3:2, respectively:  The partners agreed to liquidate the partnership after selling the other assets.

The partners agreed to liquidate the partnership after selling the other assets.

Refer to the above information. If the other assets are sold for $80,000, and all partners are personally insolvent, how much should E receive upon liquidation?

A) $0

B) $6,000

C) $10,000

D) $20,000

Correct Answer:

Verified

Q1: When is a partnership considered to be

Q6: According to UPA 1997, during partnership liquidation,

Q7: The trial balance of WM Partnership is

Q8: Bill, Page, Larry, and Scott have decided

Q9: The following condensed balance sheet is presented

Q10: Note: This is a Kaplan CPA Review

Q12: Bill, Page, Larry, and Scott have decided

Q14: Bill, Page, Larry, and Scott have decided

Q15: Note: This is a Kaplan CPA Review

Q16: Bill, Page, Larry, and Scott have decided

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents