Note: This is a Kaplan CPA Review Question

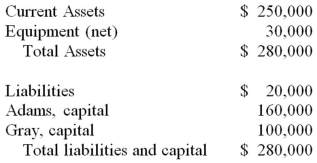

The condensed balance sheet of Adams & Gray, a partnership, at December 31, 20X1, follows:

On December 31, 20X1, the fair values of the assets and liabilities were appraised at $240,000 and $20,000, respectively, by an independent appraiser. On January 2, 20X2, the partnership was incorporated and 1,000 shares of $5 par value common stock were issued. Immediately after the incorporation, what amount should the new corporation report as additional paid-in capital?

A) $275,000

B) $215,000

C) $260,000

D) $0

Correct Answer:

Verified

Q46: The JKL partnership liquidated its business in

Q49: All assets and liabilities are transferred to

Q49: On a partner's personal statement of financial

Q51: Note: This is a Kaplan CPA Review

Q51: On a partner's personal statement of changes

Q54: Listen and Hear are thinking of dissolving

Q54: On December 31, 20X8, Mr. and Mrs.

Q55: Note: This is a Kaplan CPA Review

Q56: The computation of a safe installment payment

Q56: The partnership of Rachel, Adams, and Nixon

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents