In the AD partnership, Allen's capital is $140,000 and Daniel's is $40,000 and they share income in a 3:1 ratio, respectively. They decide to admit David to the partnership. Each of the following question is independent of the others.

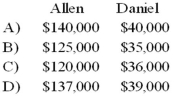

Refer to the information provided above. Allen and Daniel agree that some of the inventory is obsolete. The inventory account is decreased before David is admitted. David invests $40,000 for a one-fifth interest. What are the capital balances of Allen and Daniel after David is admitted into the partnership?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q27: Note: This is a Kaplan CPA Review

Q28: In the AD partnership, Allen's capital is

Q30: In the RST partnership, Ron's capital is

Q33: In the AD partnership, Allen's capital is

Q34: In the ABC partnership (to which Daniel

Q34: When a new partner is admitted into

Q35: In the AD partnership, Allen's capital is

Q36: When the old partners receive a bonus

Q37: When a new partner is admitted into

Q39: When a new partner is admitted into

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents