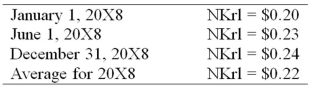

On January 1, 20X8, Transport Corporation acquired 75 percent interest in Steamship Company for $300,000. Steamship is a Norwegian company. The local currency is the Norwegian kroner (NKr) . The acquisition resulted in an excess of cost-over-book value of $25,000 due solely to a patent having a remaining life of 5 years. Transport uses the fully adjusted equity method to account for its investment. Steamship's December 31, 20X8, trial balance has been translated into U.S. dollars, requiring a translation adjustment debit of $8,000. Steamship's net income translated into U.S. dollars is $35,000. It declared and paid an NKr 20,000 dividend on June 1, 20X8. Relevant exchange rates are as follows:  Assume the kroner is the functional currency.

Assume the kroner is the functional currency.

Based on the preceding information, in the journal entry to record the receipt of dividend from Steamship,

A) Investment in Steamship Company will be credited for $3,450.

B) Cash will be debited for $3,300.

C) Investment in Steamship Company will be credited for $4,000.

D) Cash will be debited for $3,600.

Correct Answer:

Verified

Q39: On September 30, 20X8, Wilfred Company sold

Q40: On January 2, 20X8, Johnson Company acquired

Q41: Which combination of accounts and exchange rates

Q42: Note: This is a Kaplan CPA Review

Q43: Which of the following describes a situation

Q45: Mercury Company is a subsidiary of Neptune

Q46: On January 1, 20X8, Transport Corporation acquired

Q48: The British subsidiary of a U.S. company

Q49: Mercury Company is a subsidiary of Neptune

Q62: Briefly explain the following terms associated with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents