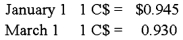

Myway Company sold equipment to a Canadian company for 100,000 Canadian dollars (C$) on January 1, 20X9 with settlement to be in 60 days. On the same date, Alman entered into a 60-day forward contract to sell 100,000 Canadian dollars at a forward rate of 1 C$ = $.94 in order to manage its exposed foreign currency receivable. The forward contract is not designated as a hedge. The spot rates were:  Based on the preceding information, the entry to revalue foreign currency payable to current U.S. dollar value on March 1 will have:

Based on the preceding information, the entry to revalue foreign currency payable to current U.S. dollar value on March 1 will have:

A) a credit to Foreign Currency Transaction Gain for $1,500.

B) a debit to Foreign Currency Transaction Loss for $2,500.

C) a debit to Foreign Currency Transaction Loss for $1,500.

D) a credit to Foreign Currency Transaction Gain for $1,000.

Correct Answer:

Verified

Q34: On November 1, 20X8, Denver Company borrowed

Q35: On December 1, 20X8, Hedge Company entered

Q36: Myway Company sold equipment to a Canadian

Q37: Taste Bits Inc. purchased chocolates from Switzerland

Q38: On December 1, 20X8, Hedge Company entered

Q40: Taste Bits Inc. purchased chocolates from Switzerland

Q41: Spiralling crude oil prices prompted AMAR Company

Q43: Note: This is a Kaplan CPA Review

Q44: On December 1, 20X8, Winston Corporation acquired

Q67: Which of the following observations is true

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents