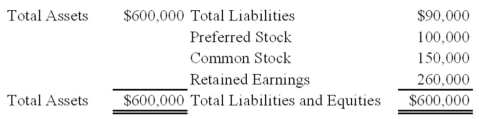

Winner Corporation acquired 80 percent of the common shares and 70 percent of the preferred shares of First Corporation at underlying book value on January 1, 20X9. At that date, the fair value of the noncontrolling interest in First's common stock was equal to 20 percent of the book value of its common stock. First's balance sheet at the time of acquisition contained the following balances:  The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1, 20X9. All of the $5 par value preferred shares are callable at $6 per share. During 20X9, First reported net income of $100,000 and paid no dividends.

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1, 20X9. All of the $5 par value preferred shares are callable at $6 per share. During 20X9, First reported net income of $100,000 and paid no dividends.

Based on the information provided, what is the book value of the common stock on January 1, 20X9?

A) $410,000

B) $360,000

C) $390,000

D) $350,000

Correct Answer:

Verified

Q10: On January 1, 20X9, Company A acquired

Q11: Micron Corporation owns 75 percent of the

Q12: Micron Corporation owns 75 percent of the

Q13: Vision Corporation acquired 75 percent of the

Q14: Winner Corporation acquired 80 percent of the

Q16: Micron Corporation owns 75 percent of the

Q17: Winner Corporation acquired 80 percent of the

Q18: Micron Corporation owns 75 percent of the

Q19: On January 1, 20X9, Company A acquired

Q20: Vision Corporation acquired 75 percent of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents