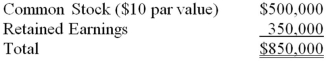

On January 1, 20X7, Pisa Company acquired 80 percent of Siena Company by purchasing 40,000 shares of Siena's common stock. There was no differential related to this transaction. The noncontrolling interest had a fair value equal to 20 percent of book value. The book value of Siena on December 31, 20X7 was as follows:  On January 1, 20X8, Pisa purchased an additional 12,500 shares directly from Siena for $25 per share.

On January 1, 20X8, Pisa purchased an additional 12,500 shares directly from Siena for $25 per share.

Based on the preceding information, the elimination entry to prepare the consolidated financial statements on December 31, 20X7 would include a:

A) credit to common stock for $625,000

B) debit to retained earnings for $37,500

C) credit to Investment in Siena Co. for $976,500

D) credit to NCI in the net assets of Siena Co. for $232,500

Correct Answer:

Verified

Q31: On January 1, 20X7, Pisa Company acquired

Q32: Cinema Company acquired 70 percent of Movie

Q33: On January 1, 20X7, Pisa Company acquired

Q34: Perfect Corporation acquired 70 percent of Trevor

Q35: Vision Corporation acquired 75 percent of the

Q37: Perfect Corporation acquired 70 percent of Trevor

Q38: On January 1, 20X9, A Company acquired

Q39: On January 1, 20X9, A Company acquired

Q40: Cinema Company acquired 70 percent of Movie

Q41: On January 1, 20X7, InfinityCorporation acquired 90

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents