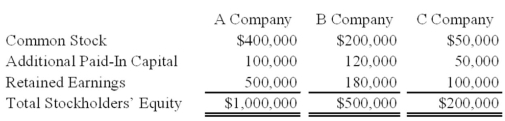

On January 1, 20X9, A Company acquired 85 percent of B Company's voting common stock for $425,000. At that date, the fair value of the noncontrolling interest of B Company was $75,000. Immediately after A Company acquired its ownership, B Company acquired 75 percent of C Company's stock for $150,000. The fair value of the noncontrolling interest of C Company was $50,000 at that date. At January 1, 20X9, the stockholders' equity sections of the balance sheets of the companies were as follows:  During 20X9, A Company reported operating income of $175,000 and paid dividends of $50,000. B Company reported operating income of $125,000 and paid dividends of $40,000. C Company reported net income of $100,000 and paid dividends of $25,000.

During 20X9, A Company reported operating income of $175,000 and paid dividends of $50,000. B Company reported operating income of $125,000 and paid dividends of $40,000. C Company reported net income of $100,000 and paid dividends of $25,000.

Based on the information provided, what amount of consolidated net income will A Company report for 20X9?

A) $175,000

B) $285,000

C) $356,250

D) $400,000

Correct Answer:

Verified

Q19: On January 1, 20X9, Company A acquired

Q20: Vision Corporation acquired 75 percent of the

Q21: X Corporation owns 80 percent of Y

Q22: On January 1, 20X7, Pisa Company acquired

Q23: Cinema Company acquired 70 percent of Movie

Q25: Cinema Company acquired 70 percent of Movie

Q27: On January 1, 20X7, Pisa Company acquired

Q28: On January 1, 20X7, Pisa Company acquired

Q29: On January 1, 20X9, A Company acquired

Q52: On January 1, 20X7, Pisa Company acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents