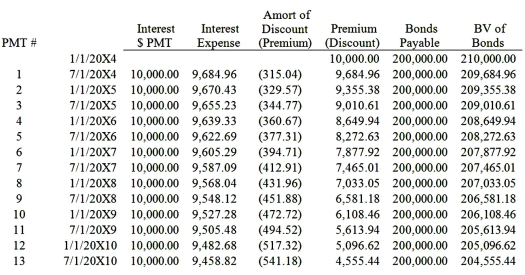

Granite Company issued $200,000 of 10 percent first mortgage bonds on January 1, 20X4, at 105. The bonds mature in 10 years and pay interest semiannually on January 1 and July 1. Mortar Corporation purchased $140,000 of Granite's bonds from the original purchaser on January 1, 20X8, for $122,000. Mortar owns 75 percent of Granite's voting common stock. Granite's partial bond amortization schedule is as follows:  Based on the information given above and assuming a 13.166 percent market rate, what amount of interest income will be eliminated in the preparation of the 20X9 consolidated financial statements?

Based on the information given above and assuming a 13.166 percent market rate, what amount of interest income will be eliminated in the preparation of the 20X9 consolidated financial statements?

A) $16,420

B) $11,494

C) $16,103

D) $11,291

Correct Answer:

Verified

Q29: Granite Company issued $200,000 of 10 percent

Q30: Hunter Corporation holds 80 percent of the

Q31: Granite Company issued $200,000 of 10 percent

Q32: Hunter Corporation holds 80 percent of the

Q33: Senior Corporation acquired 80 percent of Junior

Q36: Senior Corporation acquired 80 percent of Junior

Q37: Hunter Corporation holds 80 percent of the

Q38: On January 1, 20X7, Gild Company acquired

Q39: Granite Company issued $200,000 of 10 percent

Q49: A subsidiary issues bonds.The parent can then

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents