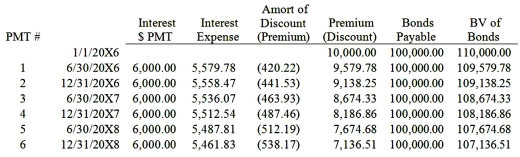

Hunter Corporation holds 80 percent of the voting shares of Moss Company. On January 1, 20X8, Moss purchased $100,000 par value 12 percent Hunter bonds from Cruse Corporation for $115,000. Hunter originally issued the bonds to Cruse on January 1, 20X6, for $110,000. The bonds have an 8-year maturity from the date of issue and pay interest semiannually on June 30 and December 31 each year. Moss' reported net income of $65,000 for 20X8, and Hunter reported income (excluding income from ownership of Moss's stock) of $90,000. Hunter's partial bond amortization schedule is as follows:  Based on the information given above and assuming an 8.735 percent market rate, what amount of consolidated net income should be reported for 20X8?

Based on the information given above and assuming an 8.735 percent market rate, what amount of consolidated net income should be reported for 20X8?

A) $147,240

B) $134,240

C) $149,134

D) $136,134

Correct Answer:

Verified

Q23: Granite Company issued $200,000 of 10 percent

Q24: Dundee Company issued $1,000,000 par value 10-year

Q25: Granite Company issued $200,000 of 10 percent

Q26: On January 1, 20X7, Gild Company acquired

Q27: On January 1, 20X7, Gild Company acquired

Q29: Granite Company issued $200,000 of 10 percent

Q30: Hunter Corporation holds 80 percent of the

Q31: Granite Company issued $200,000 of 10 percent

Q32: Hunter Corporation holds 80 percent of the

Q33: Senior Corporation acquired 80 percent of Junior

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents