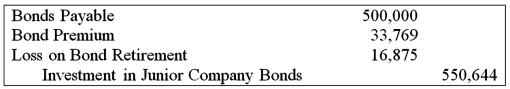

Senior Corporation acquired 80 percent of Junior Company's voting shares on January 1, 20X8, at underlying book value. On Dec. 31, 20X8, it also purchased $500,000 par value 8 percent Junior bonds, which had been issued on January 1, 20X5 to Partner Corporation (unaffiliated with either Senior or Junior) at a $45,000 premium. The bonds were originally issued with a 12-year maturity and pay interest annually on December 31. During preparation of the consolidated financial statements for December 31, 20X8, the following eliminating entry was included in the consolidation worksheet:  Based on the information given above and assuming a market rate of 6.346 percent, what is the interest income that must be eliminated in preparing the 20X9 consolidated financial statements?

Based on the information given above and assuming a market rate of 6.346 percent, what is the interest income that must be eliminated in preparing the 20X9 consolidated financial statements?

A) $33,769

B) $27,957

C) $34,946

D) $16,894

Correct Answer:

Verified

Q28: Hunter Corporation holds 80 percent of the

Q29: Granite Company issued $200,000 of 10 percent

Q30: Hunter Corporation holds 80 percent of the

Q31: Granite Company issued $200,000 of 10 percent

Q32: Hunter Corporation holds 80 percent of the

Q34: Granite Company issued $200,000 of 10 percent

Q36: Senior Corporation acquired 80 percent of Junior

Q37: Hunter Corporation holds 80 percent of the

Q38: On January 1, 20X7, Gild Company acquired

Q49: A subsidiary issues bonds.The parent can then

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents