-In the global loanable funds market,

A) when funds leave a country, a shortage of funds lowers the real interest rate.

B) when funds enter a country, a surplus of funds raises the real interest rate.

C) funds flow into countries with the highest risk- adjusted interest rates and out of countries with the lowest risk- adjusted interest rates.

D) funds flow into countries with the lowest risk- adjusted interest rates and out of countries with the highest risk- adjusted interest rates.

Correct Answer:

Verified

Q53: Net investment equals

A) capital stock minus depreciation.

B)

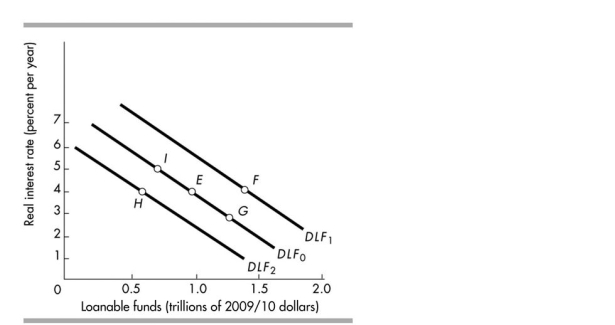

Q92: As the _ interest rate increases, the

Q93: _ increases households' saving.

A)A tax cut that

Q94: Suppose the current real interest rate is

Q95: If the Ricardo- Barro effect is present,

Q96: If net taxes exceed government expenditures, the

Q99: The term "crowding- out" relates to the

Q100: Which of the following is included in

Q101: The funds used to buy physical capital

Q102: A small country is a net foreign

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents