KM Ltd. is a Canadian-controlled private corporation, operating a small gift

store in Vancouver. The company has a December 31st year-end. KM's financial statements reported net income before taxes of $210,000 in 20X0.

Financial information relating to 20X0 is as follows:

Land adjacent to the gift shop was purchased with a $75,000 bank loan during

the year to allow for an outdoor sales area during warm weather. Interest expense on the loan for the year was $9,600, and the appraisal fees to finance the loan wa

$1,000. Both the interest and the appraisal fees were expensed by KM.

The company hired a contractor to landscape the land. The $5,000 bill for the

landscaping was paid in full during the year and capitalized on the Balance Sheet Amortization expense of $21,000 was deducted during the year. Total CCA for

the year of $16,000 was accurately recorded in the tax accounts, but was not transferred to the financial statements.

During the year, a new display case worth $2,000 was purchased and expensed on the books.

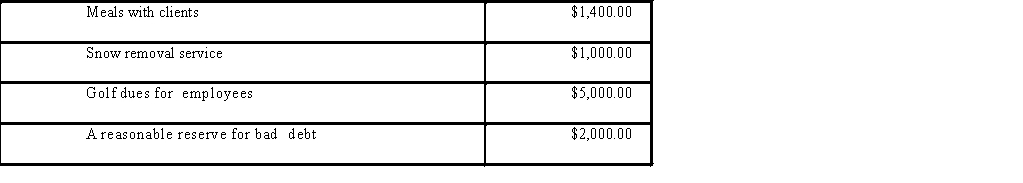

The following were also expensed during the year:

On December 30th, KM's president announced a bonus to be paid to the

On December 30th, KM's president announced a bonus to be paid to the

company's key employee in the amount of $5,000, which was expensed that day. The employee will receive the bonus in 20X1 in equal payments of $2,500, to be issued on January 30th and July 30th.

Required:

Determine KM Ltd.'s net income for tax purposes for 20X0.

Correct Answer:

Verified

Q1: Joe invested in a piece of land

Q2: Sam runs a proprietorship that generated $75,000

Q4: Which of the following regarding farming income

Q5: List the six general limitations to business

Q6: Which of the following expenses would be

Q7: Determine whether the transactions concerning the following

Q8: Alice Smith has provided you with the

Q9: TriStar Industries was recently denied the deduction

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents