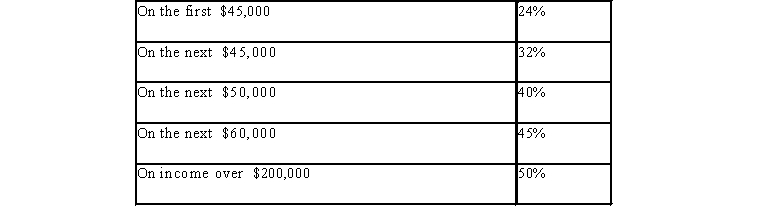

Steven James earned $150,000 this year in profits from his proprietorship, which placed him in a 45% tax bracket. The rate of tax for Canadian-controlled private corporations in his province is 15% on the first $500,000 of income. Personal tax rates (federal plus provincial) in James' province are:

(All rates are assumed for this question.)

(All rates are assumed for this question.)

Steven withdraws $3,000 per month for his personal living expenses. All remaining profits are used to pay taxes and to expand the business. Steven expects the same business after-tax profits next year.

Steven is considering incorporating his business next year. If he incorporates, he will pay himself a gross salary of $48,000.

Required:

A. Determine the increase in Steven's cash flow if he incorporates his company? Show all calculations.

B. Name the type of tax planning that Steve would be engaging in if he incorporated his company.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Certain skills are necessary for successful tax

Q2: Part A: List the three key factors

Q2: The manager at Big Company Corporation has

Q3: The manager of Little Company Ltd. has

Q6: Match each of the following terms with

Q7: Which of the following scenarios illustrates a

Q8: Which of the following statements regarding GAAR

Q9: Andrew has $10,000 to invest. He wants

Q10: For each of the examples listed below,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents