Stan is the sole shareholder of Hardware Ltd. Hardware purchased all of the shares of Tools Inc. in 20X4 for $500,000. Tools incurred a non-capital loss of

$25,000 in the year ended December 31, 20X3. Stan has decided to initiate a

Section 88 wind-up of Tools Inc. into Hardware Ltd. on June 23, 20X7. Due to the seasonal nature of his sales, Stan would like to maintain the April 30th year end that he has used since beginning his business.

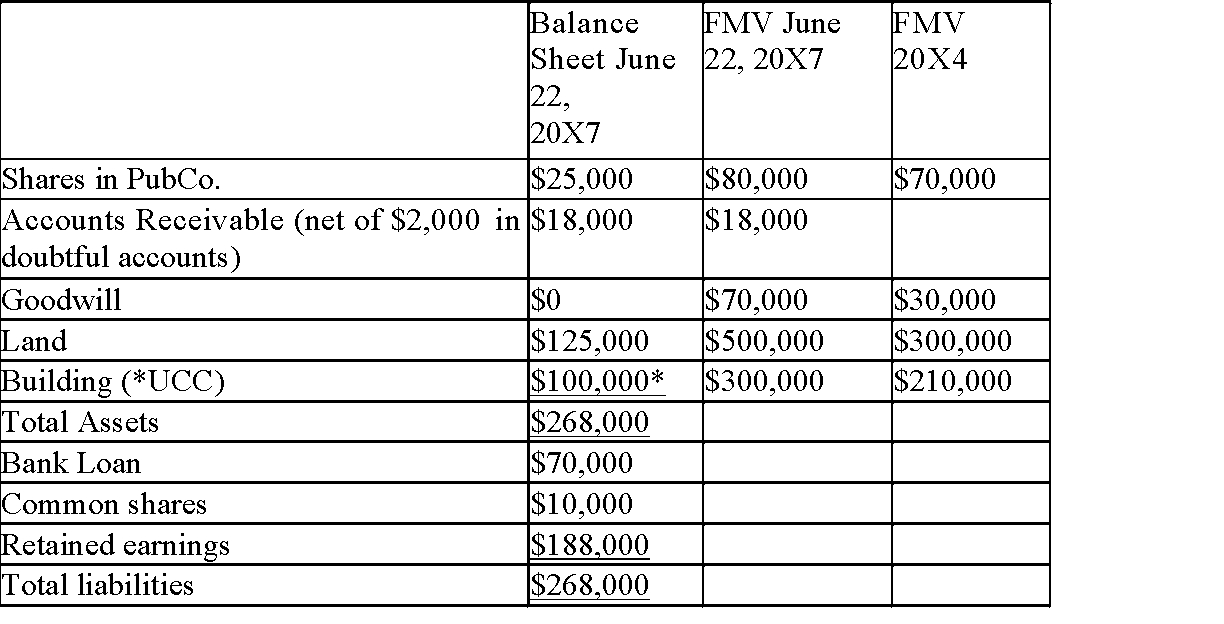

Stan's accountant has prepared the following balance sheet for Tools Inc. as of

June 22, 20X7. The fair market value of the assets on both June 22, 20X7 and the date of acquisition in 20X4 are presented in the following table:

Tools paid dividends of $8,000 to Hardware in 20X7. Required:

Tools paid dividends of $8,000 to Hardware in 20X7. Required:

Answer the following questions (filling in the charts where provided):

1) Immediately following the windup, Hardware will report the following assets at what values?

2) Calculate the value of the "bump" available on the ACB for the non-depreciable capital property.

3) Identify the assets which may use the bump, and the amount of the bump available for each asset identified. Identify any unusable bump amount.

4) Explain when Hardware will be able to use the non-capital loss from Tools.

Correct Answer:

Verified

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents