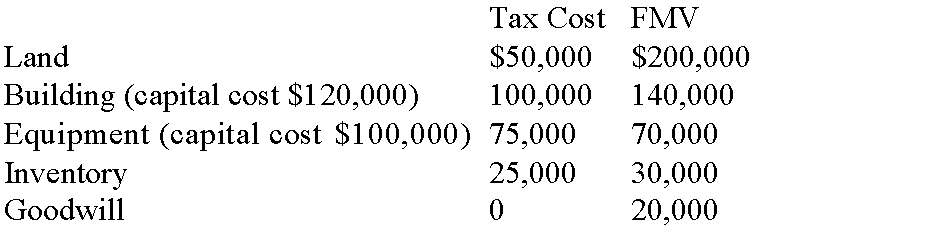

Ben is incorporating his proprietorship and would like to transfer the following assets to the new corporation:

Ben wishes to defer all gains at this time so has elected to use a section 85 rollover. He will receive the maximum note receivable possible, and the

Ben wishes to defer all gains at this time so has elected to use a section 85 rollover. He will receive the maximum note receivable possible, and the

remainder of the transfer in preferred shares. Required:

A) What is the elected value for each of the assets transferred under section 85?

B) What is the value of the note receivable that Ben will receive as a result of the section 85 rollover?

C) What is the value of the preferred shares that Ben must receive in order to defer any gains at this point in time?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Compare shareholder equity to shareholder debt, addressing

Q2: Which of the following scenarios would be

Q3: Anthony is the sole shareholder of Glass

Q4: Corporation A is a Canadian controlled private

Q5: Janko Corp. has transferred three assets to

Q6: Tony Brown sold 5000 of his shares

Q7: Which of the following statements is TRUE

Q9: Green Co. transferred a small piece of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents