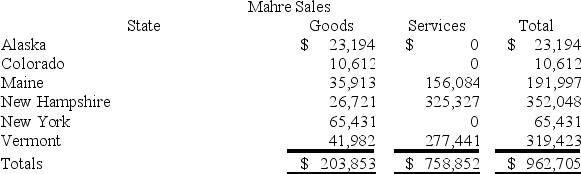

Mahre, Incorporated, a New York corporation, runs ski tours in a several states. Mahre also has a New York retail store and an Internet store, which ships to out-of-state customers. Assume sales transactions in all states, except New York, are under 200 and that all states have adopted Wayfair legislation. The ski tours operate in Maine, New Hampshire, and Vermont, where Mahre has employees and owns and uses tangible personal property. Mahre has real property only in New York. Mahre has the following sales:  Assume the following sales tax rates: Alaska (0 percent) , Colorado (7.75 percent) , Maine (8.5 percent) , New Hampshire (0 percent) , New York (8 percent) , and Vermont (5 percent) . How much sales and use tax must Mahre collect and remit?

Assume the following sales tax rates: Alaska (0 percent) , Colorado (7.75 percent) , Maine (8.5 percent) , New Hampshire (0 percent) , New York (8 percent) , and Vermont (5 percent) . How much sales and use tax must Mahre collect and remit?

A) $10,386

B) $14,543

C) $26,733

D) $61,289

Correct Answer:

Verified

Q56: Which of the following activities will create

Q61: Which of the following isn't a criterion

Q69: Mighty Manny, Incorporated, manufactures ice scrapers and

Q72: Bethesda Corporation is unprotected from income tax

Q73: What was the Supreme Court's holding in

Q74: Roxy operates a dress shop in Arlington,

Q75: Public Law 86-272 protects a taxpayer from

Q75: Mighty Manny, Incorporated, manufactures ice scrapers and

Q78: Public Law 86-272 protects solicitation from income

Q95: Which of the following isn't a typical

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents