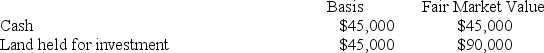

Joan is a one-third partner in the PDJ Partnership. PDJ Partnership uses the proration method to allocate income and losses to partners with varying interests. On May 1, Joan sells her interest to Freddie for a cash payment of $75,000. On January 1, Joan's basis in PDJ is $57,000. PDJ generates $60,000 of ordinary income and $9,000 of tax-exempt income during the first four months of the year. PDJ has the following assets and no liabilities at the sale date:

What is the amount and character of Joan's gain or loss on the sale?

What is the amount and character of Joan's gain or loss on the sale?

Correct Answer:

Verified

Loss of $...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: Randolph is a 30percent partner in the

Q42: Which of the following statements is true

Q53: Which of the following statements is true

Q58: Jessica is a 25percent partner in the

Q59: Kristen and Harrison are equal partners in

Q61: Daniela is a 25percent partner in the

Q62: Kathy purchases a one-third interest in the

Q63: Tyson is a 25percent partner in the

Q65: The PW Partnership's balance sheet includes the

Q74: Kathy is a 25percent partner in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents