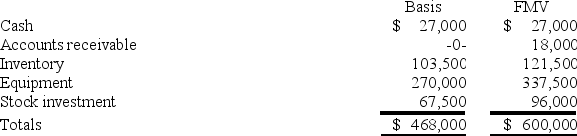

Zayde is a one-third partner in the ARZ Partnership, with an outside basis of $156,000 on January 1. Zayde sells his partnership interest to Thomas on January 1 for $180,000 cash. The ARZ Partnership has the following assets and no liabilities as of January 1:

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased three years ago. What is the amount and character of Zayde's gain or loss on the sale of his partnership interest?

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased three years ago. What is the amount and character of Zayde's gain or loss on the sale of his partnership interest?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: Tyson is a 25percent partner in the

Q71: Which of the following statements regarding hot

Q77: The PW Partnership's balance sheet includes the

Q78: Which of the following is false concerning

Q80: Kathy is a 25percent partner in the

Q80: The VRX Partnership (a calendar year-end entity)

Q81: Katrina is a one-third partner in the

Q82: BPA Partnership is an equal partnership in

Q91: Scott is a 50percent partner in the

Q99: Lola is a 35percent partner in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents