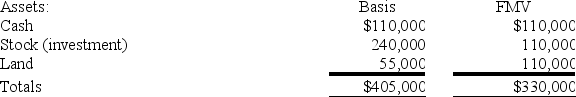

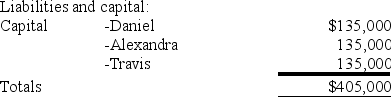

Daniel's basis in the DAT Partnership is $135,000. DAT distributes its land to Daniel in complete liquidation of his partnership interest. DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place, what is the amount and sign (positive or negative) of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

If DAT has a §754 election in place, what is the amount and sign (positive or negative) of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: Tatia's basis in her TRQ Partnership interest

Q86: Marty is a 40 percent owner of

Q89: Doris owns a one-third capital and profits

Q91: Scott is a 50percent partner in the

Q91: Carmello is a one-third partner in the

Q92: Katrina is a one-third partner in the

Q93: Nadine Fimple is a one-half partner in

Q99: Lola is a 35percent partner in the

Q105: Lola is a 35percent partner in the

Q109: Esther and Elizabeth are equal partners in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents