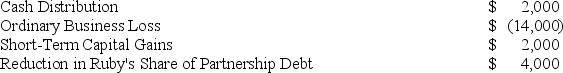

Ruby's tax basis in her partnership interest at the beginning of the partnership's tax year was $13,000. The following items were included in her Schedule K-1 from the partnership for the year:

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities.

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: On March 15, 20X9, Troy, Peter, and

Q85: ER General Partnership, a medical supplies business,

Q86: On April 18, 20X8, Robert sold his

Q86: Jordan, Inc., Bird, Inc., Ewing, Inc., and

Q91: KBL, Inc., AGW, Inc., Blaster, Inc., Shiny

Q98: On March 15, 20X9, Troy, Peter, and

Q103: Greg, a 40percent partner in GSS Partnership,

Q111: What general accounting methods may be used

Q119: Why are guaranteed payments deducted in calculating

Q121: Explain why partners must increase their tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents