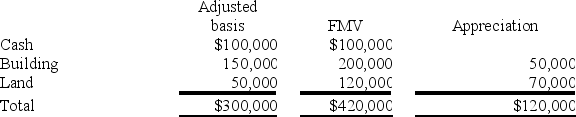

Gary and Laura decided to liquidate their jointly owned corporation, Amelia, Inc. After liquidating its remaining inventory and paying off its remaining liabilities, Amelia had the following tax accounting balance sheet.

Under the terms of the agreement, Gary will receive the $100,000 cash in exchange for his interest in Amelia. Gary's tax basis in his Amelia stock is $30,000. Laura will receive the building and land in exchange for her interest in Amelia. Laura's tax basis in her Amelia stock is $60,000.

Under the terms of the agreement, Gary will receive the $100,000 cash in exchange for his interest in Amelia. Gary's tax basis in his Amelia stock is $30,000. Laura will receive the building and land in exchange for her interest in Amelia. Laura's tax basis in her Amelia stock is $60,000.

What amount of gain or loss does Laura recognize in the complete liquidation and what is Laura's tax basis in the building and land after the complete liquidation?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Ken and Jim agree to go into

Q87: Ken and Jim agree to go into

Q90: In December 2019, Zeb incurred a $100,000

Q92: Mike and Michelle decided to liquidate their

Q97: Mike and Michelle decided to liquidate their

Q98: Gary and Laura decided to liquidate their

Q101: Sue transferred 100 percent of her stock

Q103: Simon transferred 100 percent of his stock

Q118: Rich and Rita propose to have their

Q120: The City of Boston made a capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents