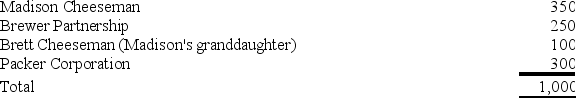

Geneva Corporation, a privately held company, has one class of voting common stock, of which 1,000 shares are issued and outstanding. The shares are owned as follows:

Madison has a 20 percent interest in the partnership. The remaining 80 percent is owned by unrelated individuals. Madison owns 40 percent of Packer Corporation. The other 60 percent is owned by her father.

Madison has a 20 percent interest in the partnership. The remaining 80 percent is owned by unrelated individuals. Madison owns 40 percent of Packer Corporation. The other 60 percent is owned by her father.

How many shares of stock is Madison deemed to own under the family attribution rules in a stock redemption?

Correct Answer:

Verified

Madison is deemed to own her shares,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: Pine Creek Company is owned equally by

Q88: Walloon, Inc. reported taxable income of $1,000,000

Q89: Loon, Inc. reported taxable income of $600,000

Q91: Goose Company is owned equally by Val

Q92: Crescent Corporation is owned equally by George

Q95: Tiger Corporation, a privately held company, has

Q99: Otter Corporation reported taxable income of $400,000

Q102: Ozark Corporation reported taxable income of $500,000

Q112: Sweetwater Corporation declared a stock distribution to

Q114: Tappan declared a 100 percent stock distribution

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents