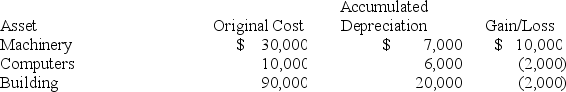

Brandon, an individual, began business four years ago and has never sold a §1231 asset. Brandon owned each of the assets for several years. In the current year, Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability?

A) $7,000 ordinary income, $1,000 §1231 loss, and $1,920 tax liability.

B) $6,000 ordinary income and $1,920 tax liability.

C) $7,000 §1231 gain and $2,240 tax liability.

D) $7,000 §1231 gain and $1,050 tax liability.

E) None of the choices are correct.

Correct Answer:

Verified

Q61: Winchester LLC sold the following business assets

Q62: Maryexchanged an office building used in her

Q65: Ashburn reported a $105,000 net §1231 gain

Q85: Peroni Corporation sold a parcel of land

Q89: The general rule regarding the exchanged basis

Q93: Which of the following may qualify as

Q94: Each of the following is true except

Q98: Manassas purchased a computer several years ago

Q100: Arlington LLC exchanged land used in its

Q111: Sunshine LLC sold furniture for $75,000. Sunshine

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents