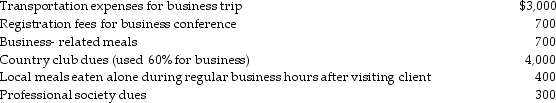

Rita, a self- employed CPA, incurred the following expenses during the year:  What is Rita's deduction for the year with respect to the above expenses and where will she deduct these expens her tax return? Assume Rita maintains all appropriate documentation.

What is Rita's deduction for the year with respect to the above expenses and where will she deduct these expens her tax return? Assume Rita maintains all appropriate documentation.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Charishma, a CPA, paid the following expenses

Q21: Taxpayers may use the standard mileage rate

Q22: Rajiv, a self- employed consultant, drove his

Q23: Shane, a partner in a law firm,

Q24: What factors are considered in determining whether

Q26: David acquired an automobile for $30,000 for

Q27: Chuck, who is self- employed, is scheduled

Q29: If an employee incurs travel expenditures and

Q29: A self-employed consultant takes a client to

Q32: A self-employed consultant takes a client to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents