Martin Corporation granted a nonqualified stock option to employee Caroline on January 1, 2013. The option price was $150, and the FMV of the Martin stock was also $150 on the grant date. The option allowed Caroline to purchase 1,000 shares of Martin stock. The option itself does not have a readily ascertainable FMV. Caroline exercised the option on August 1, 2017, when the stock's FMV was $250. If Caroline sells the stock on September 5, 2018, for $300 per share, she must recognize

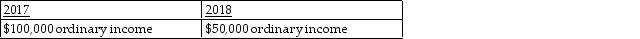

A)

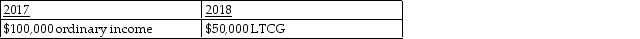

B)

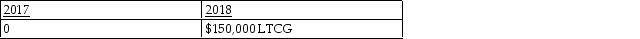

C)

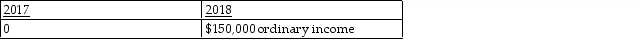

D)

Correct Answer:

Verified

Q89: Tyne is a 48- year- old an

Q90: Tyler (age 50) and Connie (age 48)

Q91: Martin Corporation granted an incentive stock option

Q92: Which statement is correct regarding SIMPLE retirement

Q93: Jackson Corporation granted an incentive stock option

Q95: Wilson Corporation granted an incentive stock option

Q96: Which of the following statements is incorrect

Q97: Which of the following statements is incorrect

Q98: Mirasol Corporation granted an incentive stock option

Q99: Which of the following is true about

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents