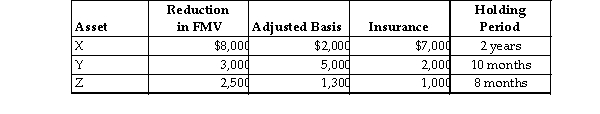

In the current year, Marcus reports the following casualty gains and losses on personal- use property. Assets X and Y are destroyed in the first casualty while Z is destroyed in a second casualty.Both casualties were the result of federal disasters.  As a result of these losses and insurance recoveries, Marcus must report

As a result of these losses and insurance recoveries, Marcus must report

A) a long- term capital gain of $5,000 on asset X; a short- term capital loss of $900 on asset Y; and a short- term capital loss of $200 on asset Z.

B) a long- term capital gain of $5,000 on asset X; a short- term capital loss of $900 on asset Y; and a short- term capital loss of $300 on asset Z.

C) a long- term gain of $4,900 on asset X; a short- term capital loss of $900 on asset Y; and a short- term capital loss of $200 on asset Z.

D) a net gain of $3,700.

Correct Answer:

Verified

Q71: If a taxpayer suffers a loss attributable

Q197: Lena owns a restaurant which was damaged

Q199: What is required for an individual to

Q200: Hope sustained a $3,600 casualty loss due

Q201: Juanita, who is single, lives in an

Q203: Ella is a cash- basis sole proprietor

Q204: Constance, who is single, lives in an

Q205: A taxpayer suffers a casualty loss on

Q206: Determine the net deductible casualty loss on

Q207: Taj operates a sole proprietorship, maintaining the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents