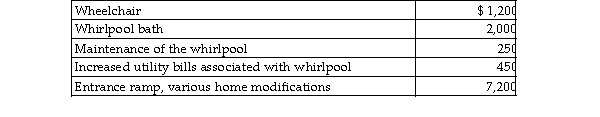

Alan, who is a security officer, is shot while on the job. As a result, Alan suffers from a chronic leg injury and mu wheelchair and undergo therapy to regain and retain strength. Alan's physician recommends that he install a wh bath in his home for therapy. During the year, Alan makes the following expenditures:  A professional appraiser tells Alan that the whirlpool has increased the value of his home by $1,000. Alan's dedu medical expenses (before considering limitations based on AGI) will be

A professional appraiser tells Alan that the whirlpool has increased the value of his home by $1,000. Alan's dedu medical expenses (before considering limitations based on AGI) will be

A) $7,000.

B) $10,100.

C) $7,700.

D) $6,000.

Correct Answer:

Verified

Q29: A personal property tax based on the

Q38: Assessments or fees imposed by the government

Q39: Foreign real property taxes and foreign income

Q263: Linda had a swimming pool constructed at

Q265: Leo spent $6,600 to construct an entrance

Q266: Explain under what circumstances meals and lodging

Q270: Discuss the timing of the allowable medical

Q271: All of the following payments for medical

Q272: Caleb's 2018 medical expenses before reimbursement for

Q273: Mr. and Mrs. Gere, who are filing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents