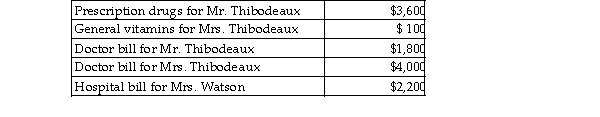

Mr. and Mrs. Thibodeaux (both age 35) , who are filing a joint return, have adjusted gross income of $100,000 in 2018. During the tax year, they paid the following medical expenses for themselves and for Mrs. Thibodeaux's mother, Mrs. Watson (age 63) . Mrs. Watson provided over one- half of her own support.  Mr. and Mrs. Thibodeaux received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Mr. and Mrs. Thibodeaux received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

A) $2,000

B) $9,400

C) $4,100

D) $1,900

Correct Answer:

Verified

Q18: If a medical expense reimbursement is received

Q39: Foreign real property taxes and foreign income

Q270: Discuss the timing of the allowable medical

Q271: All of the following payments for medical

Q272: Caleb's 2018 medical expenses before reimbursement for

Q273: Mr. and Mrs. Gere, who are filing

Q275: A review of the 2018 tax file

Q276: Patrick and Belinda have a twelve- year-

Q277: Mitzi's 2018 medical expenses include the following:

Q278: Van pays the following medical expenses this

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents