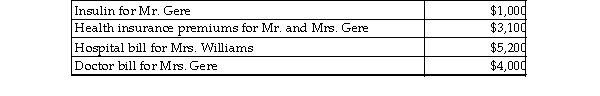

Mr. and Mrs. Gere, who are filing a joint return, have adjusted gross income of $50,000 in 2018. During the tax ye they paid the following medical expenses for themselves and for Mrs. Gere's mother, Mrs. Williams. The Gere's c claim Mrs. Williams as their dependent, but she has too much gross income.  Mr. and Mrs. Gere (both age 40) received no reimbursement for the above expenditures. What is the amount of t deductible itemized medical expenses?

Mr. and Mrs. Gere (both age 40) received no reimbursement for the above expenditures. What is the amount of t deductible itemized medical expenses?

A) $13,300

B) $8,300

C) $9,550

D) $5,200

Correct Answer:

Verified

Q39: Foreign real property taxes and foreign income

Q268: Alan, who is a security officer, is

Q270: Discuss the timing of the allowable medical

Q271: All of the following payments for medical

Q272: Caleb's 2018 medical expenses before reimbursement for

Q274: Mr. and Mrs. Thibodeaux (both age 35),

Q275: A review of the 2018 tax file

Q276: Patrick and Belinda have a twelve- year-

Q277: Mitzi's 2018 medical expenses include the following:

Q278: Van pays the following medical expenses this

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents