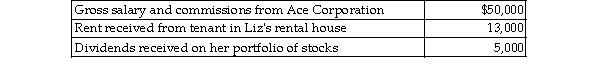

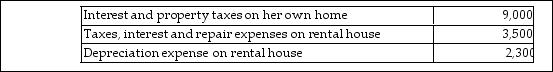

Liz, who is single in 2018, lives in a single family home and owns a second single family home that she rented for the entire year at a fair rental rate. Liz had the following items of income and expense during the current year. Income:  Expenses:

Expenses:  What is her adjusted gross income for the year?

What is her adjusted gross income for the year?

A) $62,200

B) $64,300

C) $68,000

D) $53,200

Correct Answer:

Verified

Q7: Generally,expenses incurred in an investment activity other

Q28: In order for an expense to be

Q388: Mark and his brother, Rick, each own

Q389: Assume Congress wishes to encourage healthy eating

Q391: Discuss why the distinction between deductions for

Q393: Maria pays the following legal and accounting

Q394: Deductions for AGI may be located

A) on

Q395: To be tax deductible by an accrual-

Q396: Laura, the controlling shareholder and an employee

Q397: Leigh pays the following legal and accounting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents