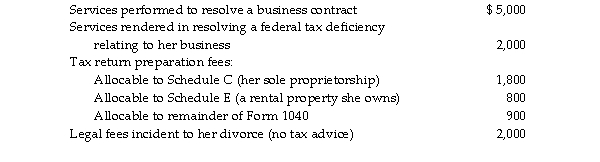

During the current year, Lucy, who has a sole proprietorship, pays legal and accounting fees for the following:  What amount is deductible for AGI?

What amount is deductible for AGI?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: A sole proprietor contributes to the election

Q40: Kickbacks and bribes paid to federal officials

Q44: Business investigation expenses incurred by a taxpayer

Q59: A taxpayer opens a new business this

Q411: Mickey has a rare blood type and

Q412: During the current year, Ivan begins construction

Q413: Which of the following factors is important

Q417: During 2018 and 2019, Danny pays property

Q419: During the current year, the United States

Q421: Paul, a business consultant, regularly takes clients

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents