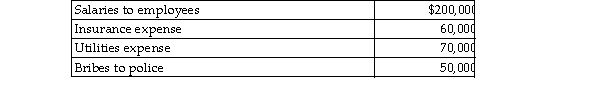

Troy incurs the following expenses in his business, an illegal gambling establishment:  His deductible expenses are

His deductible expenses are

A) $200,000.

B) $380,000.

C) $330,000.

D) $0.

Correct Answer:

Verified

Q38: A sole proprietor contributes to the election

Q44: Business investigation expenses incurred by a taxpayer

Q64: Expenses paid with a credit card are

Q66: What must a taxpayer do to properly

Q69: Points paid in connection with the purchase

Q417: During 2018 and 2019, Danny pays property

Q419: During the current year, the United States

Q421: Paul, a business consultant, regularly takes clients

Q424: Desi Corporation incurs $5,000 in travel, market

Q427: Tory considered opening a cupcake store in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents