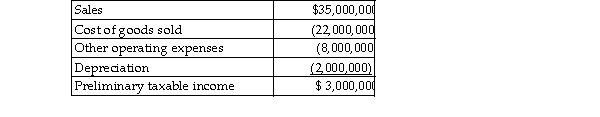

2020 Enterprises, owned by Xio who also manages the businesses, has generated more than $25 million of sales f of the past five years. This year it is reporting the following income and deduction amounts:  Xio just received a statement from the bank reporting interest expense of $1,800,000 on a loan to 2020 Enterprises fund operations and equipment purchases. How much of the interest expense can 2020 Enterprises deduct in co this year's taxable income?

Xio just received a statement from the bank reporting interest expense of $1,800,000 on a loan to 2020 Enterprises fund operations and equipment purchases. How much of the interest expense can 2020 Enterprises deduct in co this year's taxable income?

A) $1,500,000

B) $1,800,000

C) $900,000

D) $540,000

Correct Answer:

Verified

Q78: A small business uses the accrual method

Q428: Pat, an insurance executive, contributed $1,000,000 to

Q429: Business interest expense is limited for larger

Q430: In March of the current year, Marcus

Q431: Rachel, a self- employed business consultant, has

Q434: Super Development Company purchased land in the

Q435: Toni owns a gourmet dog treat shop

Q436: Toby, owner of a cupcake shop in

Q437: During the current year, Charlene borrows $10,000

Q438: Doug, a self- employed consultant, has been

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents