Rob sells stock with a cost of $3,000 to his daughter for $2,200, which is its fair market value. Later the daughter sells the stock for $3,200 to an unrelated party. Which of the following describes the tax treatment to Rob and Daughter?

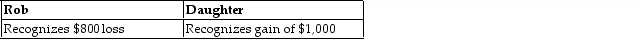

A)

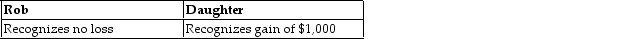

B)

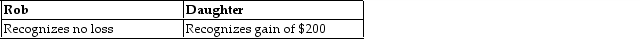

C)

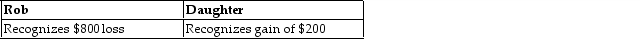

D)

Correct Answer:

Verified

Q81: If a loss is disallowed under Section

Q84: If an activity produces a profit for

Q86: Generally,Section 267 requires that the deduction of

Q87: The term "principal place of business" includes

Q93: A taxpayer owns a cottage at the

Q98: Expenses related to a hobby are deductible

Q472: Which of the following individuals is not

Q477: Erin, Sarah, and Timmy are equal partners

Q479: Victor, a calendar- year taxpayer, owns 100

Q481: Diane, a successful accountant with an annual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents