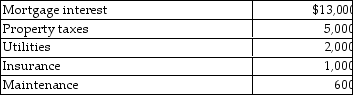

Ola owns a cottage at the beach. She and her family use the property for 30 days during the summer season and to unrelated parties for 60 days. The rental receipts amount to $8,000. Total costs of operating the property are as follows:  In addition, potential depreciation expense is $9,000.

In addition, potential depreciation expense is $9,000.

a. Is the cottage subject to the vacation home rental limitations of IRC Sec. 280A?

b. How much of expenses can Ola deduct?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Losses are generally deductible if incurred in

Q9: Capital recoveries increase the adjusted basis of

Q494: Lloyd purchased 100 shares of Gold Corporation

Q495: During the current year, Paul, a single

Q496: For the years 2014 through 2018 (inclusive)

Q497: Discuss tax planning considerations which a taxpayer

Q498: Abby owns a condominium in the Great

Q500: Kelsey enjoys making cupcakes as a hobby

Q501: Jack exchanged land with an adjusted basis

Q504: Which one of the following does not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents