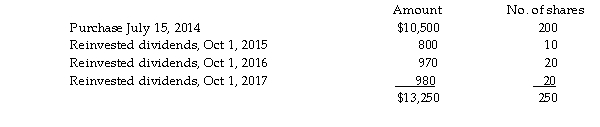

Joy purchased 200 shares of HiLo Mutual Fund on July 15, 2014, for $10,500, and has been reinvesting dividends December 15, 2018, she sells 100 shares.  What is the basis for the shares sold assuming (1) FIFO and (2) average cost method?

What is the basis for the shares sold assuming (1) FIFO and (2) average cost method?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q70: Bad debt losses from nonbusiness debts are

Q556: In 2016, Toni purchased 100 shares of

Q557: In the current year, Andrew received a

Q558: Kathleen received land as a gift from

Q559: In a community property state, jointly owned

Q560: Bob owns 100 shares of ACT Corporation

Q562: Which of the following is not a

Q564: Armanti received a football championship ring in

Q565: Gina owns 100 shares of XYZ common

Q566: All of the following are capital assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents