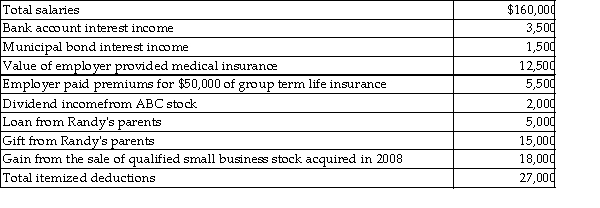

Randy and Sharon are married and have two dependent children. Their 2018 tax and other related information i follows:  Compute Randy and Sharon's taxable income. (Show all calculations in good form.)

Compute Randy and Sharon's taxable income. (Show all calculations in good form.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q96: Exter Company is experiencing financial difficulties.It has

Q99: Connor owes $4 million and has assets

Q103: The tax law encourages certain forms of

Q742: In September of 2018, Michelle sold shares

Q744: Chloe receives a student loan from a

Q745: Taylor begins a new job as a

Q746: This year, Jonathan sold some qualified small

Q748: Jamal, age 52, is a human resources

Q750: The discharge of certain student loans is

Q751: Adam purchased stock in 2006 for $100,000.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents