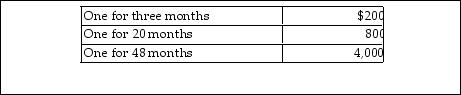

CT Computer Corporation, a cash- basis taxpayer, sells service contracts on the computers it sells. At the beginni January of this year, CT Corporation sold contracts with service to begin immediately:  The amount of income CT Corporation must report for this year is

The amount of income CT Corporation must report for this year is

A) $1,680.

B) $5,000.

C) $200.

D) $1,000.

Correct Answer:

Verified

Q35: Interest on Series E and Series EE

Q39: A check received after banking hours is

Q40: Interest credited to a bank savings account

Q804: Which of the following advance payments cannot

Q805: An individual buys 200 shares of General

Q806: Examples of income which are constructively received

Q807: Norah, who gives music lessons, is a

Q808: Speak Corporation, a calendar- year, accrual- basis

Q812: Ms. Marple's books and records for 2018

Q814: The Cable TV Company, an accrual- basis

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents